Seguro de vida indexado en estados unidos – Indexed life insurance in the United States, a captivating financial instrument, has garnered significant attention in recent times. This comprehensive guide delves into the intricacies of indexed life insurance, exploring its benefits, risks, suitability, and regulatory landscape. By unraveling the complexities of this innovative insurance product, we aim to empower individuals with the knowledge necessary to make informed decisions regarding their financial well-being.

Indexed life insurance stands out from traditional life insurance policies by offering the potential for growth linked to a specific market index, such as the S&P 500. This unique feature introduces an element of investment into the realm of life insurance, potentially providing policyholders with the opportunity to accumulate cash value while maintaining life insurance coverage.

Definition of Indexed Life Insurance in the United States

Indexed life insurance is a type of life insurance that provides a death benefit that is linked to a stock market index, such as the S&P 500. This means that the death benefit can increase or decrease in value based on the performance of the index.

Indexed life insurance policies also typically offer a cash value component that can grow over time, similar to a traditional whole life insurance policy.

Indexed life insurance differs from traditional life insurance policies in that the death benefit is not fixed. With traditional life insurance, the death benefit is a set amount that is paid out to the beneficiary upon the policyholder’s death. With indexed life insurance, the death benefit can fluctuate based on the performance of the stock market index.

Benefits of Indexed Life Insurance, Seguro de vida indexado en estados unidos

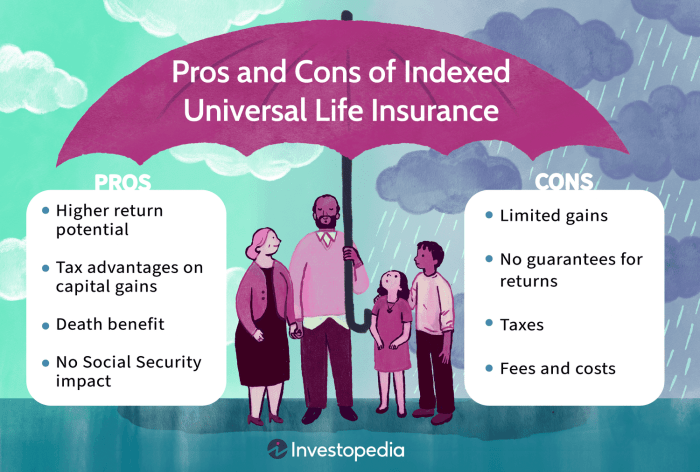

Indexed life insurance offers a number of potential benefits, including:

- Potential growth:The cash value component of an indexed life insurance policy can grow over time, providing the policyholder with a potential source of retirement income or a way to save for other financial goals.

- Protection:Indexed life insurance provides a death benefit that can help protect the policyholder’s family in the event of their death.

- Flexibility:Indexed life insurance policies offer a number of flexible features, such as the ability to adjust the death benefit and cash value component over time.

Risks and Considerations of Indexed Life Insurance

There are also some potential risks and considerations associated with indexed life insurance, including:

- Market risk:The death benefit and cash value component of an indexed life insurance policy are linked to the performance of a stock market index. This means that the value of the policy can fluctuate based on the performance of the index.

- Fees:Indexed life insurance policies typically have higher fees than traditional life insurance policies.

- Complexity:Indexed life insurance policies can be complex and difficult to understand. It is important to speak with a financial advisor to make sure that you understand the policy before you purchase it.

FAQ Explained: Seguro De Vida Indexado En Estados Unidos

What is the key difference between indexed life insurance and traditional life insurance?

Indexed life insurance offers the potential for cash value growth linked to a market index, while traditional life insurance policies typically provide a fixed death benefit.

Are there any risks associated with indexed life insurance?

Yes, market fluctuations can impact policy values, potentially leading to lower-than-expected returns or even losses.

Who is indexed life insurance suitable for?

Indexed life insurance may be appropriate for individuals seeking both life insurance coverage and the potential for long-term growth.